WARRANTY INFORMATION

Hearts On Fire has a lifetime manufacturer’s warranty on all jewelry. We cover repair or replacement costs for jewelry that has been deemed defective, however we do not cover normal wear and tear.

We do recommend insuring your jewelry for loss, theft or accidental damage.

DOCUMENT OF PURCHASE

When you buy Hearts On Fire jewelry online, you will receive a Document of Purchase with your new piece. Keep this documentation for your records and make a copy for your insurance company. They will add a rider to your existing policy and charge you annually.

PROTECT YOUR PURCHASE

Jewelers Mutual®Group has provided the content on this page.

We’ve collaborated with Jewelers Mutual, the leader in jewelry insurance, to remind you of the importance of protecting your beautiful and timeless jewelry from loss, theft, damage and even disappearance. Whether it’s an engagement ring or a gift to yourself, protecting your jewelry is quick, easy and allows you to wear without worry.

A policy from Jewelers Mutual typically costs 1-2% of the jewelry’s value per year and checking how much it will cost you takes less than a minute.

Get My Free Quote

About Jewelers Mutual

For over 100 years, Jewelers Mutual has been offering protection from loss, damage, theft and even disappearance. Your most prized jewelry possessions don't simply reflect light, they are reflections of you and of life's most important moments. When you're covered by Jewelers Mutual, you have the ability to wear your jewelry without apprehension.

Jewelers Mutual personal jewelry insurance advantages include:

- Comprehensive worldwide coverage while traveling that extends beyond ordinary homeowners insurance

- Protection against theft, damage, accidental loss, and disappearance

- The option to choose your own jeweler

- Repair of damaged jewelry with the same level of quality as the original

- Replacement of lost jewelry with the same brand and type

- Graduate Gemologists (GIA) with a passion for jewelry on staff

How a Jewelers Mutual policy stands out

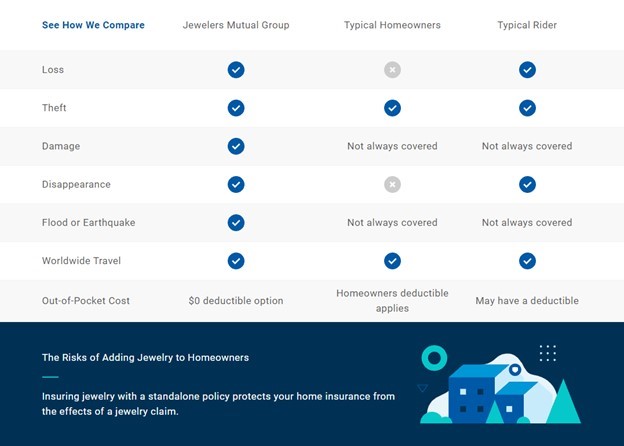

Jewelry is typically covered under renters and homeowners insurance policies, however, that coverage is normally not enough to cover the full replacement cost. Even a jewelry-specific rider added to your homeowner's policy has its limits.

If you have any questions about jewelry insurance from Jewelers Mutual, please email personaljewelry@jminsure.com or call 888-884-2424.

*Insurance coverage only available in the United States (all 50 states and the District of Columbia) and Canada (excluding Quebec).

Must be at least 18 years of age to apply for insurance. Although Hearts on Fire may offer opinions to consumers about the importance of protecting their purchases, Hearts on Fire is not a licensed agent and does not sell or offer advice about insurance. Any/all decisions for protecting jewelry must be made by the consumer, following information gathering. The purchase of insurance must be done by direct interaction with an insurer or license insurance agent.

Coverage is subject to the provisions, limitations, exclusions, and endorsements in the policy and the level of coverage you select. Coverage is offered by either Jewelers Mutual Insurance Company, SI (a stock insurer) or JM Specialty Insurance Company. Policyholders of both insurers are members of Jewelers Mutual Holding Company. Any coverage is subject to acceptance by the insurer and to policy terms and conditions.

By clicking the link above — “get my free quote” — you authorize Jewelers Mutual to use a secure system to retrieve and save details of this purchase from us for the purpose of calculating an insurance quote. Retrieved information may include your name and address.